CAPTIVE CONSULTANCY

About us

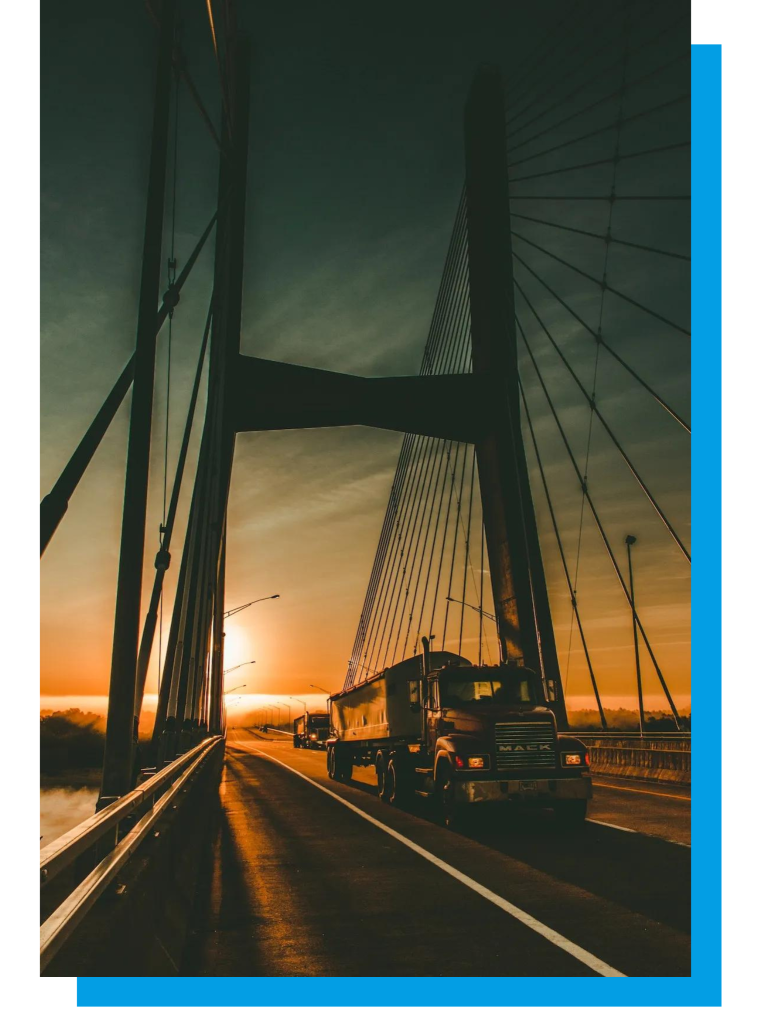

Captive Consultancy group are risk management experts that provides a captive insurance platform to mid-size Canadian transportation companies for their transportation businesses.

Our mission is to enable business owners to regain control over their risk and make tangible decisions that allow longevity to their business

We believe in transparency and ensure that you are in control of every risk element of your business

The Secret of Success

WHAT IS A CAPTIVE?

A captive insurer is a means to structure a business in a way which owns its own risk. This enables the captive insurer to recognize the unique risk profile of the business being insured and provide more flexibility, unlike what can be obtained through the general insurance market.

WHY USE A CAPTIVE?

The rationale for using captive insurance resides in the ability to consolidate and control risk at the parent company, which in turn allows for lower premiums thanks would otherwise be available in the general insurance market.

Captives work with each carrier's safety and management team to create an accurate fleet profile. easily understood by the insurance industry.

Captives provide

recommendations, which can lead to improved safety scores, better rates, and more complete analysis for underwriting.

Captives also create an individual cell with a commercial license for their fleets, which allows companies to share their insurance profits with the reinsurance market - helping them increase their margins and take advantage of their safety improvements

WEIGHING PROS & CONS

Pros:

- Financial: reduced costs, improved cash flow, source of additional revenue, tax benefits, profit center creation

- Insurance: coverage for risks not covered in the traditional market, improved negotiation position, reduced commercial insurance, direct access to reinsurance markets improved claims handling and data collection, and better risk management

Cons:

- Capital commitment (for reserves and loss pics). captive capital erosion by adverse operating results, costs of maintaining operations

WHO IS A CAPTIVE RIGHT FOR?

Businesses that prefer to put their own capital at risk by creating their own insurance company are good candidates. Once established, the subsidiary functions as commercial insurers do, including producing the issuance of policies, buying insurance, and receiving commission from reinsurance

CONSIDER A CAPTIVE IF…

- Premiums are at $1+ million

- Good historical loss experience

- Commercial market availability

- Risk retention appetite

- Dedicated management resources are available

© 2023 CAPTIVE CONSULTANCY